AMD just published its financial results for the Q4 of 2022 and it is looking strong in some areas but also lost significant revenue in others.

Despite lower demands in the mainstream CPU and GPU market, AMD was able to generate higher revenue compared to 2021 whether it was the Q4 of 2022 that saw a steep decline in CPU-GPU sales or the full year.

There are a few things to point out for why it had positive growth overall and why it did better than Intel which had a record-breaking loss of approximately $700M in decades.

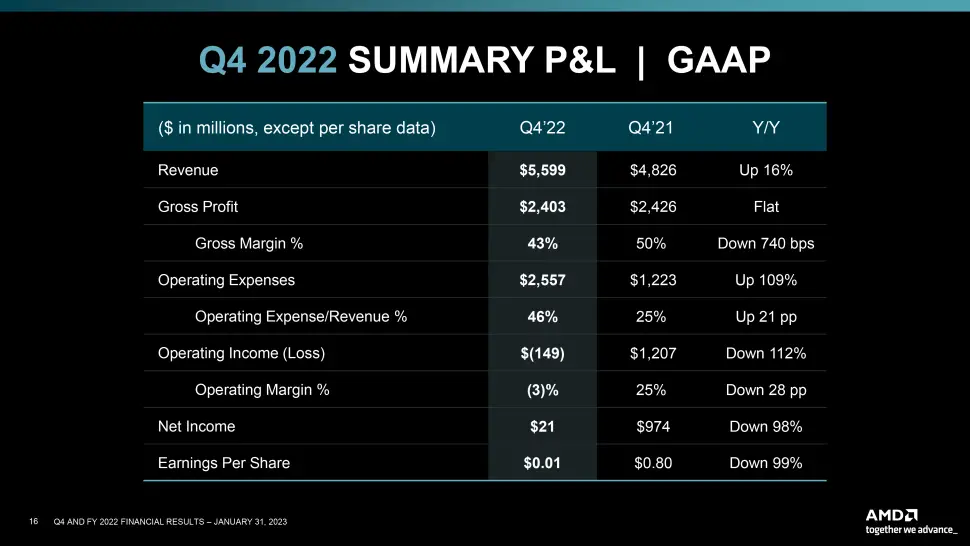

AMD’s Q4 2022 Summary chart shows that the revenue increased by 16% compared to Q4 of 2021 and the gross profit remains as it is. This is not because of its gaming or client segments but rather most of the profits came from the Embedded and Datacenter.

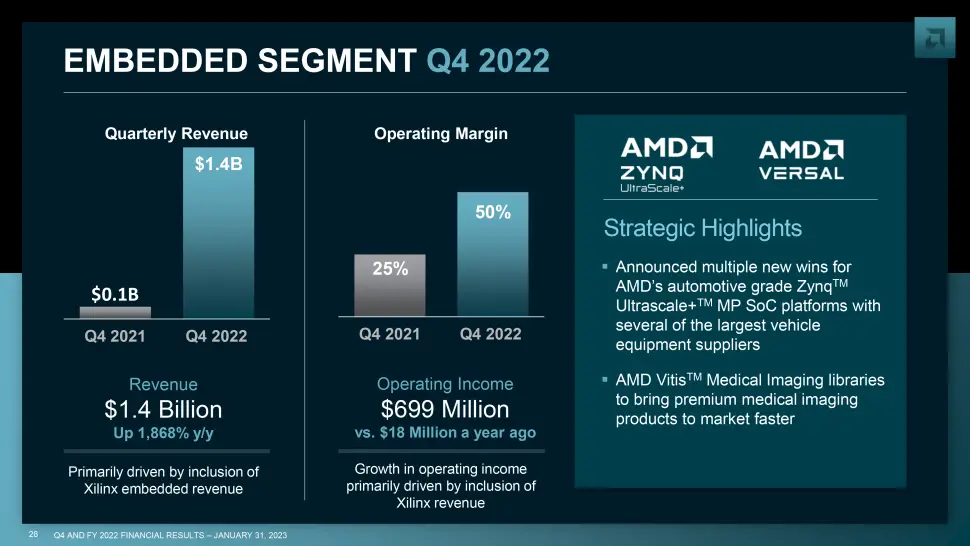

The latter segments saw significant growth compared to 2021 where the Embedded segment which is largely automotive and aerospace based saw a quarterly revenue of $1.4B which is 1868% higher than the Q4 of 2021.

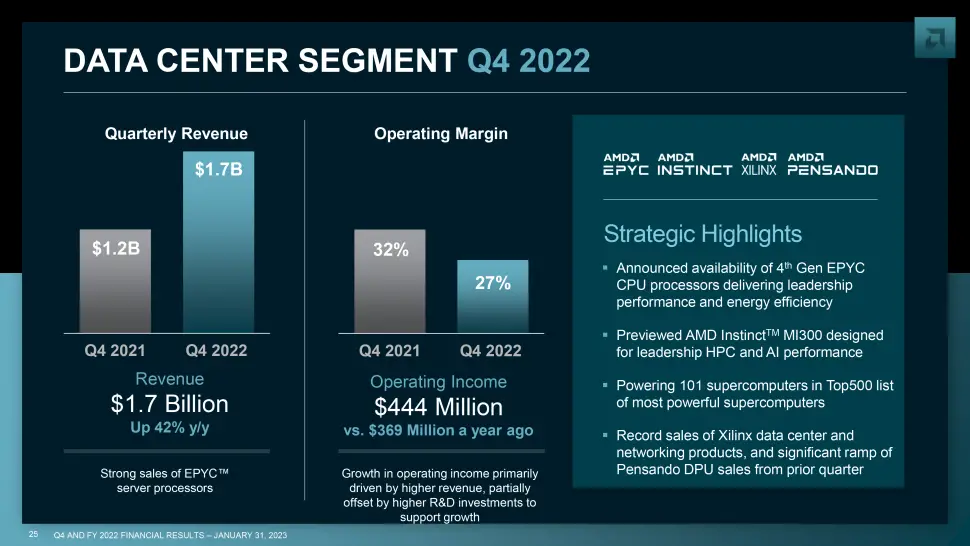

The data segment also saw a bigger growth compared to Q4 2021 even though the operating margins were 5% lower than the previous year. This shows that there was a strong demand for EPYC processors for servers which contributed to the overall financial growth in 2022.

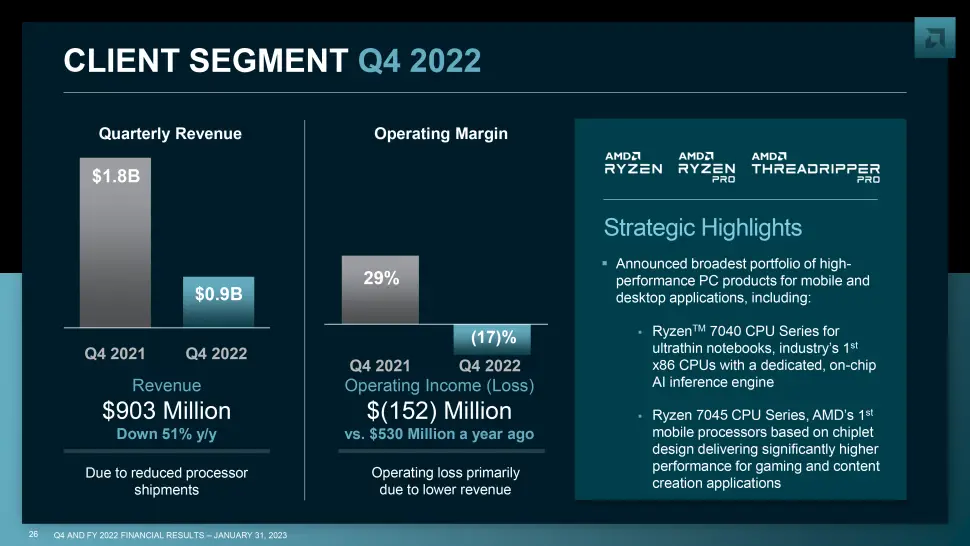

The Client segment saw a significant decline in revenue by 51% and lost $152 million dollars in the operating margin. This was the only area where AMD saw negative growth compared to Q4 2021 where it had a significantly better operating income margin of $530M.

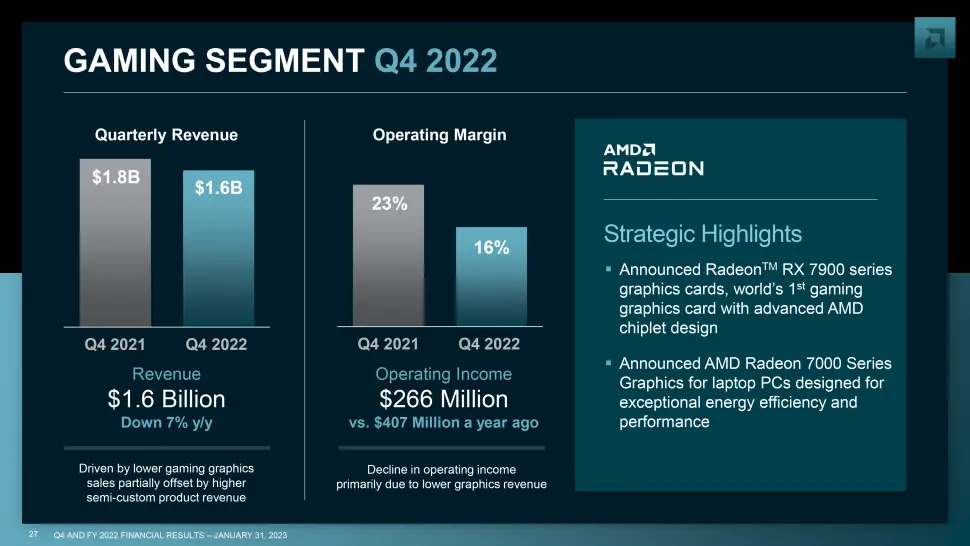

Fortunately, the gaming segment didn’t see a huge loss and mostly because AMD sold a lot of system-on-chips for consoles in 2022, and that saved it from a catastrophic loss like Intel. AMD did ok with only 7% lower YoY growth but had around 53% lower operating margin compared to Q4 2021.

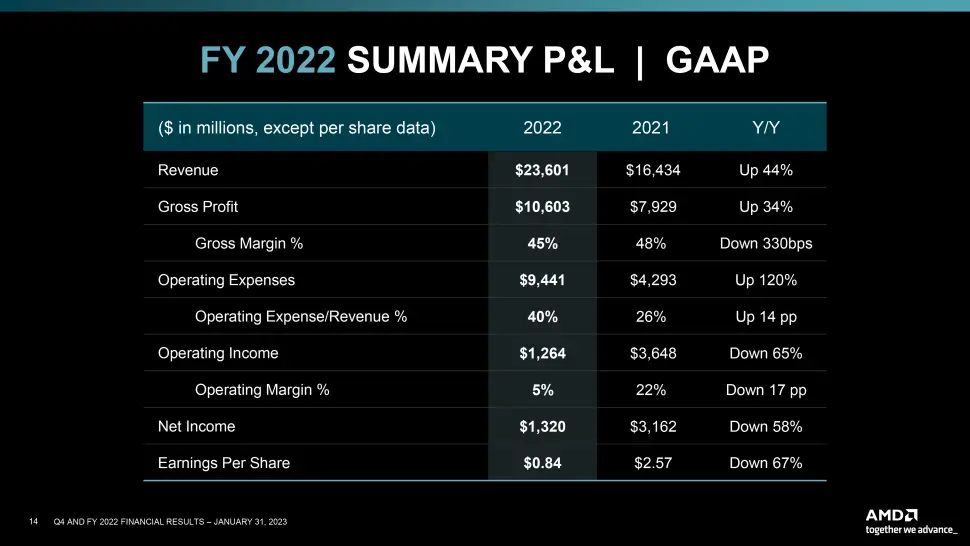

The overall revenue and gross profit for 2022 remained strong at 44% and 34% YoY respectively but the Net Income was reduced significantly by 58%.

AMD expects that its first quarter 2023 revenue would be 10% lower compared to the previous year because of the lower consumer demands for CPUs and graphics cards.

Via: Tomshardware